Transcript:

My name is Shaun McMillan, and this is the Best Class Ever.

Making Decisions in the Face of Uncertainty

Last week we spoke about Game Theory and prisoner’s dilemma. I will likely return to the subject of prisoner’s dilemma to explore it more deeply in the future, but for now we are looking for strategies to deal with the problem of uncertainty. In life we need to make critical choices without all of the relevant information. We don’t know what will happen even two minutes from now, yet we need to make choices that will affect our plans for years out into the future. Where should I go to college? Should I move to a new city? What kind of career should I pursue? Should I try to be my own boss or start a business in the future? Should I be an artist, an athlete, or devote myself to developing my talents in some other highly competitive field? The problem that all of these considerations have in common is risk. The risk of failure. The risk of spending your time, your money, and your youth only to embarrass yourself.

A Basic Primer on Statistical Distributions

With life there is always risk, but when choosing between two options should you consider whether one option is more risky than the other? Should we always just blindly follow our intuition or should we research the competition before committing our most valuable resources? Can we use math to measure risk versus reward? Today we will talk about probabilities, chance, and statistics.

The Normal Distribution

Now when it comes to using statistics to evaluate competition, many of us may be familiar with the bell curve. The easiest way to understand the bell curve is to imagine you are in a university college course with more than a hundred students. The teacher may give everyone a really insanely hard final exam. Or he may decide to give a really easy exam. It doesn’t matter, because instead of grading you based on how many answers you get correct, he will instead grade you based on how you compare to all of the other students in the class. The top 10% of the students who score the highest will all get As for the class. But a great majority of the students who score only a little more or less better than average will all get Cs for the class. They are after all only slightly below or above average. This is called grading against the bell curve, because if we plot out on a chart how every student scores, there will be a huge amount of students scoring a little above or below average and a much smaller percentage who score extremely high or extremely low. These are the outliers.

It’s not only true for student scores, but even if we plot the results of numbers that are initially totally random, there will be results that fall into the midrange and less at the extremes. We also call this regression towards the means, but you can think of it more simply as most people are average. This is easy to understand and fairly intuitive. Maybe that’s why we call it mathematically, “the normal distribution.”

To see what this chart looks like simply visit www.BestClassEver.org/charts

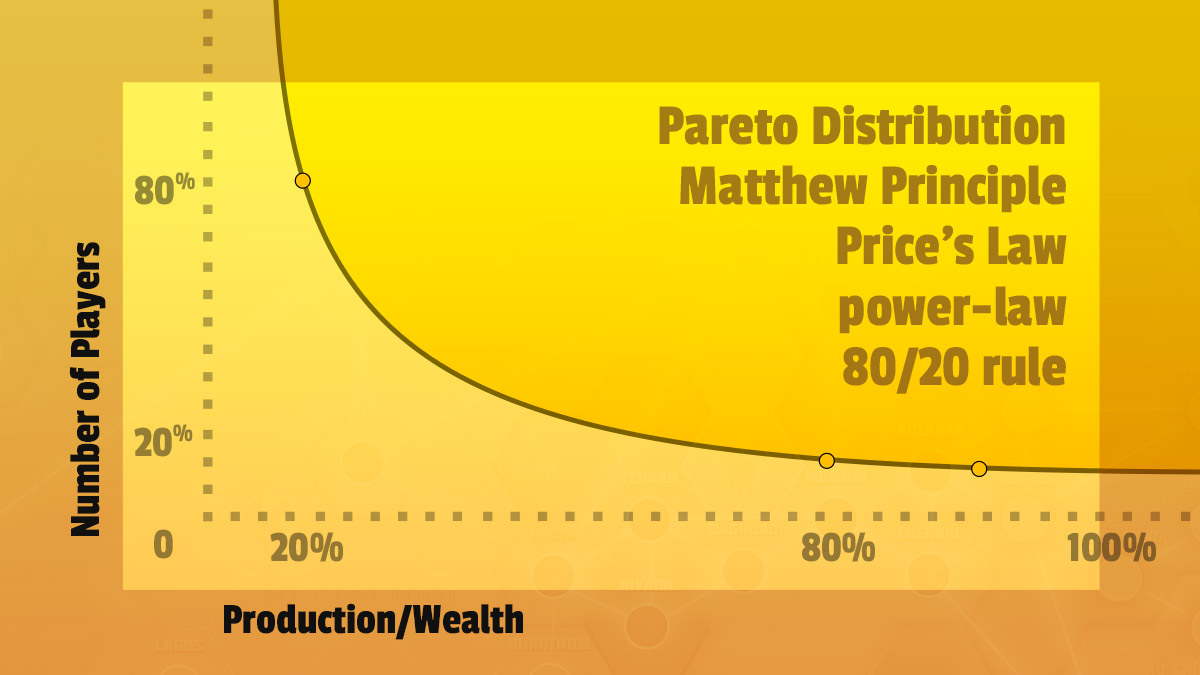

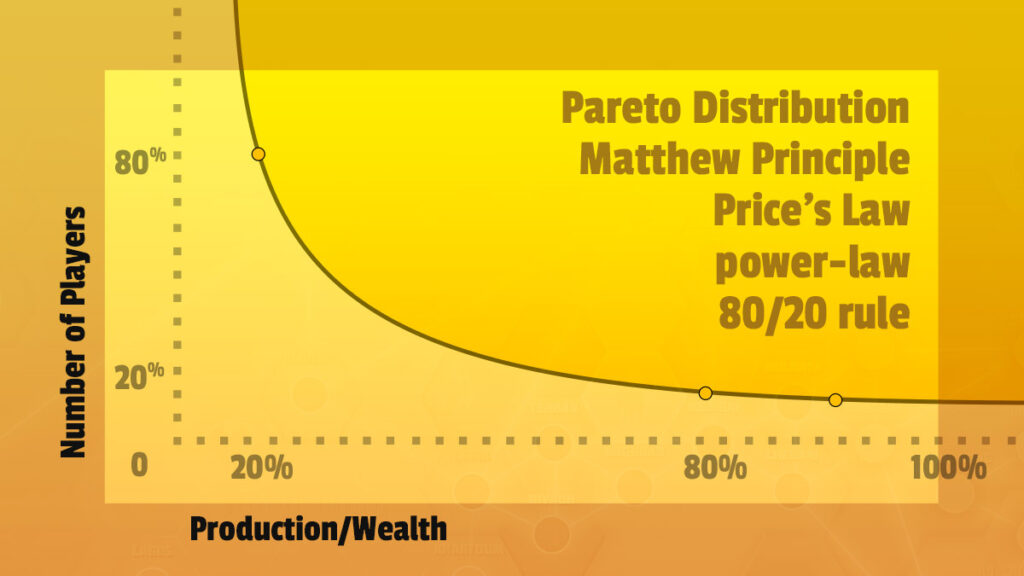

Pareto Distribution a.k.a. Price’s Law a.k.a. “The Matthew Principle”

But there is another principle in statistics that far less people know about, but is extremely useful to know. And this idea is known mathematically as, “The Pareto distribution.” It’s also referred to as Price’s Law or the Matthew Principle based on the scripture in Matthew 25:29 quoting Jesus,

“to everyone who has will more be given; but from him who has not, even what he has will be taken away.”

– Matthew 25:29

Also Known as the 80/20 Rule

More crudely it is known as the 80/20 rule. It is often used to describe wealth inequality showing that 20% of the population typically has 80% of the wealth as a way to illustrate the unfairness of some particular economic system. But it is not a feature of just capitalism or socialism. This is the typical distribution of any system involving creativity or chance aka randomness. A minority of the players in any game typically achieve a majority of the results. Or we can say that a minority of the causes bring about a majority of the effects.

You can see what this chart looks like and how it differs from the normal distribution at www.BestClassEver.org/charts

Monopolies – Opportunities Lead to More Opportunities

Let’s think of a very simple economic simulation. Let’s look at a game of monopoly. In the beginning everyone starts out equal with the exact same amount of money. Each gets the same fair chance at drawing totally random cards. But after each round, each roll of the dice, and each chance at another opportunity, those who get a slightly better card in the beginning collect more rent, those who roll higher pass go more often, and with more money gain more opportunity to acquire more expensive assets. At first the difference is small, but missing out on or gaining an opportunity early in the game can snowball into more opportunities to cash in on more and more opportunities.

Spiraling towards 0

On the other end, once you start losing money, it can easily spiral into more and more punishing losses. And once you hit zero, all of your money goes to the players who are already ahead of everyone else. So now they are increasingly getting ahead faster and faster against fewer and fewer players. Even if we had a huge number of players like we would in a real market, it will eventually get to the point where the lead player has more than half of the wealth. The second-most successful player might have half as much as the lead player, and third half of what the second has, and the fourth with half as much as third’s half, fifth with a little more than half of that, and each is left with maybe half or more of what the person ahead of them has. Near the middle class there is more equality, but those near the bottom fight for exponentially less of what the middle class have and begin desperately fighting against the very real possibility of going bankrupt at any moment.

The distribution of wealth and opportunity gets more and more unequal the more rounds you play. If you play it out to its ultimate conclusion all of the wealth will inevitably go to the one player who gains the monopoly.

Pareto

This simple power-law pattern was discovered in 1897 by Paris-born engineer Vilfredo Pareto and he applied it to Europe’s wealth distribution. But economists later found that it really only applied to the rich. Remember that Monopoly is a simulation of how the rich play the market. For them, opportunities lead to more opportunities. For the rest of us, the poor tend to remain poor sharing the same amount of wealth unless we have significantly better saving habits which allows those who save to take advantage of the occasional fortunate opportunity.

But we can see the pattern in other places as well. If we look at music or Youtube we can see that the most popular songs and videos get 80-90% of the attention. If you belong to any kind of hobby or sport, you know that only the top performers continually achieve what everyone else can only hope for all the luck in the world to achieve. You never hear about the majority of players who can’t achieve a livable wage producing mediocre results, but we tell stories and talk endlessly about those top performing athletes, musicians, and YouTubers providing them fame that leads to even more opportunities. At a certain point people are watching Youtubers not because their videos are good, but only to see why so many other people are watching their videos to the point that the views alone are causing them to get more views. Opportunity leads to more opportunity.

Zero-Sum Games

On the other end, especially in the case of the game of Monopoly, failure can spiral into more failure, if those failures cause you to lose critical resources. This happens in Monopoly because Monopoly, like most war games, is a zero-sum game. A zero-sum game is one in which there is a finite amount of resources and one player must take from another player to get richer. Luckily for us, most of life and even global markets are not zero-sum. You do not have to lose in order for me to win. In fact trade has replaced war as the most common strategy between nations because trade allows both my wealth and your wealth to increase. Most sustainable businesses are mutually beneficial for the buyers and the sellers.

Bankruptcy

The critical resource for businesses is time and money. Any business that is spending more than it earns in revenue is counting the days until it cannot pay its employees. The day it fails to make payroll it must claim bankruptcy which means game over. But for individuals, we can keep playing the game so long as we are still alive and refuse to give up. As Winston Churchill said, “Success Is Going from Failure to Failure Without Losing Your Enthusiasm.”

Power-Law Patterns Apply to Far More than just Wealth Distribution

This power-law dynamic is a pattern very common in nature and cannot simply be blamed on unjust politics or unfair economic systems. Politicians can propose policies to redistribute wealth, and YouTube can make changes to its algorithm, but this pattern runs much deeper than can easily be corrected for. As we said earlier, it applies more to those getting the best results, but there are far too many variables to account for at the lower end. We can see how this applies to popular music, because even if we look only at one particular musician’s published songs, if they have produced enough music we will see that 20% of their songs will get 80% more attention than their other songs. It is a natural phenomena. There are countless classical composers from the long history of the classical music genre, but how many famous classical composers can you name off the top of your head? Most of us can think only of Mozart, Beethoven, Chopin, Tchaikovsky, Bach, and perhaps Brahms or a couple more. And of all of Beethoven’s songs, how many can you think of? The ninth, moonlight sonata, the fifth? Again, probably less than you can count on two hands.

How Do We Use This Pattern to Our Advantage?

There are far more large cities than small cities, but those few large cities contain so much more of the population. 20% of trees are so large that they achieve 80% of the total tree sizes. What kind of policy would you implement in nature to try and change this if it were deemed unfair or undesired? It would be fruitless to fight against this pattern, but how could we use it to our advantage?

Keep Your Most Productive Time Sacred

The first key way is to look at how you spend your time. You probably get as much as 80% of your work done during the 20% of your time that you work with a focused mind and without distraction. The other 80% of your time may feel like work, but you are really just spinning your wheels. Or even worse, you could be multi-tasking which has the double effect of making you feel like you are working hard, while in reality you are just doing twice as much as you should half as well as you could. Working while constantly being distracted by email, by your cell phone, by alerts from social media, or by interruptions by other people is not work at all. It’s just ignorantly blissful busywork.

In his popular book, the 8-hour work week, Tim Ferris argues that a full time employee can accomplish more while working less than everyone else if he comes in early and focuses on getting serious work done in the early hours before everyone else begins interrupting you with meetings, questions, emails, and other distractions.

In fact these early morning hours and the way you spend them may just be the easiest way to get ahead in life. There may only be three hours in a typical day when you are well rested, fully alert, and not distracted, but if you can work on what matters at that time, then you may become one of those top 10-20% performers who accomplish 80% of the achievements. So find that time and keep it sacred.

No one can predict what new existential threats nature will throw at us, from the daily weather to planet changing ecological events like floods, an unexpected ice age, or asteroids striking the planet. But luckily evolution also uses randomness in the form of mutations. As Darwin discovered, organisms are randomly changing over time and occasionally these unexpected mutations allow us to uniquely deal with unexpected surprises in the environment. This is survival of the fittest, or adaptation. Most of these random mutations have little to no effect on an organism’s ability to deal with threats, but every so often one mutation uniquely allows an organism to deal with the chaos of nature in a more effective way. And of course that organism will survive and live to reproduce more like itself.

For us we can use the same strategy in the form of creativity. Creativity is anything that is both novel and useful. Novel means something truly original. Useful means it isn’t just weird for being weird’s sake, but actually provides utility. Someone has to find that new idea useful.

But because creativity is something new that doesn’t already previously exist, that makes it nearly impossible to measure or evaluate. But we do know that most new ideas are likely to fail, but a very small amount of them will be spectacularly successful. This is why creativity is a high risk high reward strategy. A strategy that almost always fails, but when it wins it wins big. It is a costly but necessary strategy because any organization that doesn’t innovate and adapt will eventually become obsolete.

Conduct Low-Cost Experiments

So how do we find these rare but critical new ideas? Easy, just constantly look for them. Explore, research, be adventurous. Read about new trends and follow thought leaders who seem to have good intuition. Constantly conduct small experiments that cost very little if they fail, but could reap big rewards if they show promise. Reward those who bring in new ideas. Encourage creativity, innovation, and exploration.

Something from Nothing – Quiet and Solitude

Who is that intuitive thought leader who can accurately predict what problems the future will hold and be innovative enough to present a useful solution? This is the job of every leader and entrepreneur. Who will have the vision and the intuition to prepare before calamity strikes, to build an ark before the flood, or catch the next big wave and ride the trend before it fizzles out?

To come up with the newest most useful ideas and create something from nothing you cannot be busy all of the time. You must use your time effectively to make room for quiet and solitude. If you are constantly dealing with the stress of the present, how can you predict the problems of the future?

Work smart, not hard. Use your time effectively and take the time you invest in yourself and your future seriously.

- The 3-4 hours of time we spend working most effectively, while well rested, without distraction should be kept sacred and used only for the most critical work that needs to be done each day (the most productive 10-20% of your day).

- Creativity is a high risk high reward but very necessary strategy.

- We need to optimize our daily reality and make time for exploration in order to prepare for the future.

- Invest more in your most productive domain (specialize) while constantly investing in low-cost experimentation to find the next big idea. Invest a lot in a little while investing a little in a lot.

Next Lesson

So next week we will talk more about the randomness of results, and how to define success in a way that is healthy for our mental health and within our locus of control. We will also conduct a thought experiment invented by the ancient Stoic philosophers to help us deal honestly with our greatest fears.

As always you can learn the other strategies for dealing with uncertainty in the previous weeks, get notes on today’s lesson, and subscribe to the podcast at www.BestClassEver.org